The boating market reached full normalization in 2023, and this year continues to show similar trends. As high interest rates and inflation persist, consumer demand continues to wane, with global searches related to boat purchasing dropping by 7.6% in the first half of 2024 compared to the same period last year. Despite some positive indicators, the overall picture shows a market still adjusting to post-pandemic realities and changing economic conditions.

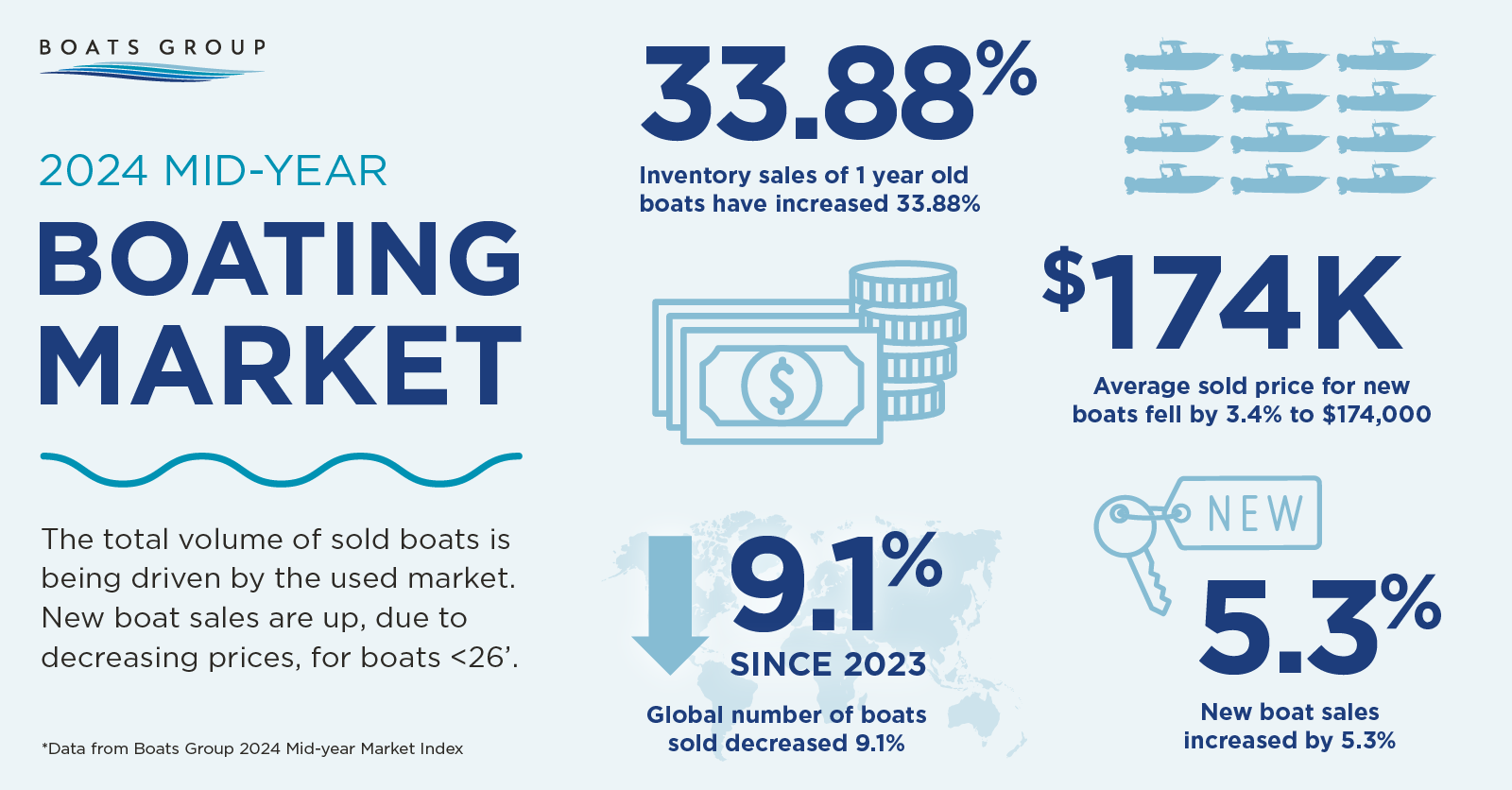

The downward trend in YoY boat sales over recent years continued in the first half of 2024, as global sales dropped by 9.1%. However, a deeper dive into this data reveals the trend between new and used boats; sales of new boats saw an increase of 5.3%, while used boat sales were down by 12.4%. This echoes the trend seen overall in 2023, when new boats outperformed used boats in total unit sales.

Despite the increase in new boat sales, they continue to take longer to sell, spending 53 days longer on the market compared to the same period last year. Also following trends seen last year, boats just one-year-old are taking the longest to sell, spending an additional 75 days on the market compared to the same period in 2023. Similar to trends seen in 2023, this is likely due to increased new boat inventory on the market, motivating buyers to buy new versus pre-owned – especially as average prices have not adjusted to the demand headwinds.

The first half of 2024 saw a positive trend in average sold boat prices, rising globally by 2.4% to $203,000 – in contrast to the flattening prices seen in 2023. However, there is again a notable difference based on the boat’s condition; the average sold price for new boats fell by 3.4% to $174,000, while for used boats, it increased by 4.2% to $211,500. With new boats selling for less than they did a year ago, coupled with better financing options for new vessels, this contributes to driving higher sales volumes, while used boat prices remain higher despite decreasing demand. Consequently, the total value of used boat sales dropped by 9%, whereas the value of new boat sales increased by 0.6%.

The primary market driver for global unit sales in the first half of 2024 is boats less than 26 feet, with total sales in the first half of the year totaling over 12,000. According to data from soldboats.com, reported by brokers and dealers across the globe, the average vessel price for this segment has dropped by 2.5% to $91,000 – likely driven by increased supply and normalized demand, pushing the average sold price down. It is worth noting that for the 36-45 foot segment, while total sales dropped by 12.3%, it saw an 18% increase in the average sale price, rising to $327,000.

The boating market’s current landscape is one of contrasts and adjustments. While new boat sales are climbing, used boat sales are falling sharply. Inventory levels, pricing trends, and economic pressures continue to shape buyer behavior and market dynamics.

The 2024 Mid-Year Market Index from Boats Group includes a market analysis of boats sold by length group, location, power versus sail, and more.